Transforming Insurance Documentation: Tech & Best Practices for 2025

Paper files, scattered digital systems, and manual workflows frustrate your team and your customers.

Outdated documentation processes are costing the industry big time. A fact that insurance firms are well aware of. In a 2024 survey of 200 US insurance executives, a massive 76% are already using AI.

Adopting new technology is what keeps you competitive and relevant. It’s about giving your customers the rapid, transparent service they expect while making it easier and faster for your team to do their job with accuracy.

This article explores how emerging tools like 3D digital twins and automated AI-powered systems help you cut costs, speed up processing, and deliver better experiences.

Common challenges with traditional insurance document management

It’s no secret that manual processes waste time and create opportunities for human error. When your team needs to find a document, they might spend hours digging through filing systems or searching across multiple digital platforms. You've got departments working in silos, with intake teams, adjusters, underwriters, and processors all using a stitched-together mix of software.

The following issues are common in document management:

Document retrieval takes hours instead of seconds due to poor organization

Version control nightmares and scattered systems across multiple platforms block collaboration

Manual filing systems prone to errors and misfiling and vulnerable to fires, floods, and human error

Traditional systems lack built-in protections for UK GDPR, PECR, and FCA guidance

It’s not just about your team members; your customers feel the impact of these inefficiencies too. Research shows that 30% of dissatisfied claimants switched carriers in the past two years because of poor claims experiences.

Beyond these foundational challenges, when disasters strike, physical access limitations prevent rapid response when time matters most. And when claims disputes arise, the lack of clear, verifiable documentation often leads to expensive litigation.

Emerging technologies reshaping insurance documentation

The insurance industry is undergoing a major tech upgrade, and the tools becoming available today can solve problems that seemed impossible to fix just a few years ago.

These technologies represent massive growth opportunities, with 78% of insurance organizations planning to increase tech spending in 2025:

Comprehensive 3D digital twins of property interior and exterior

AI & OCR automation tools that speed up processing

Increasing API integrations to connect all your systems

The sections below explore each of these in detail.

3D digital twins for comprehensive property data

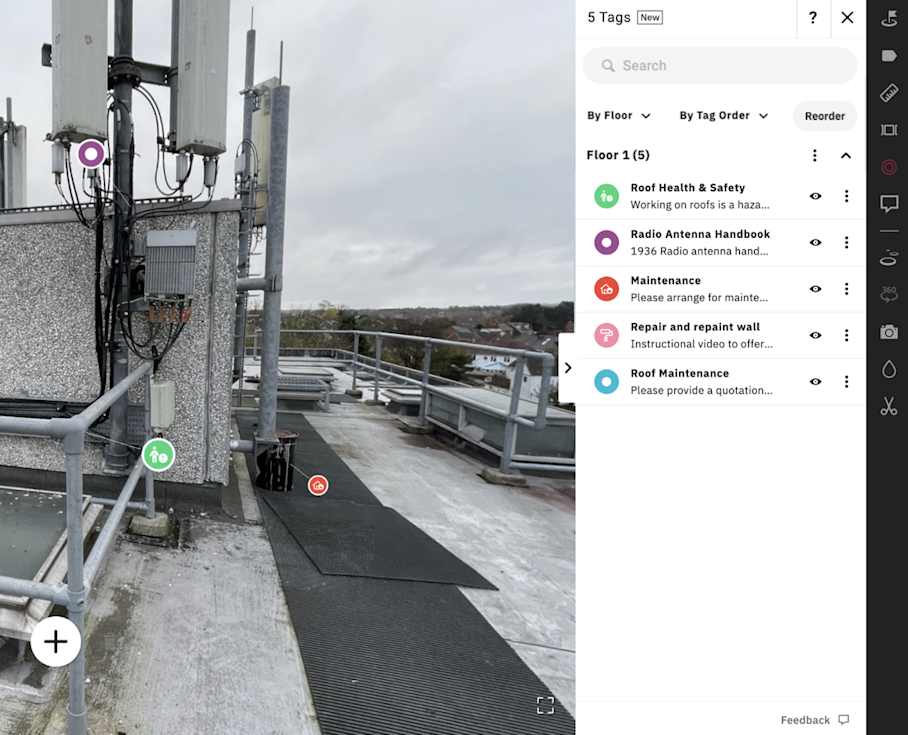

Digital twins create interactive, photorealistic 3D models that you can navigate like walking through the actual space. Unlike traditional photos, these models capture precise measurements and let you add annotations, files, and photos directly to specific locations.

For insurers and claimants alike, digital twins serve as neutral evidence in disputes and enable portfolio-scale monitoring with real-time updates, capabilities that are impossible with traditional documentation methods.

The practical benefits are immediate: remote property inspections, real-time collaboration regardless of location, and rapid deployment during disasters.

Artificial intelligence and OCR automation

AI is truly overhauling how insurance companies handle routine paperwork and data extraction. OCR, or Optical Character Recognition, is basically the automated conversion of images of text into editable, searchable digital text. This, combined with AI, turns entire databases into searchable documentation.

Here are a few examples of tools that are using AI to revolutionize document processing:

Matterport Sketch: AI-generated, accurate loss sketches without requiring manual sketching that quickly give insurers a key document in the event of a loss claim.

Hyperscience: 99.5% accuracy in document processing, with deep learning algorithms that continuously improve through human feedback.

ABBYY Vantage: Automatically classifies documents, extracts data, and validates information against business rules.

Microsoft Azure AI Document Intelligence: Uses AI for form recognition, layout analysis, and handwriting recognition.

IBM Watson Discovery: Uses NPL to analyze sentiment, relationships between data points, and perform contextual AI searches

Google Cloud Document AI: Enterprise-level model training and real-time processing of various document formats.

Amazon Textract: Detects text, extracts form data, and processes tables as well as confidence scoring and natural language queries for document analysis.

API integrations for seamless connectivity

APIs connect your documentation systems directly to insurance-specific workflows, eliminating the bottlenecks that slow down claims processing and underwriting decisions.

Modern insurance APIs enable powerful documentation workflows:

Claims intake systems automatically pull property scans and damage photos into adjuster workflows

Estimating platforms like Cotality receive floor plans and measurements directly from 3D scanning platforms

Policy management systems sync updated property documentation during renewals without manual file transfers

This connectivity means your documentation flows seamlessly from capture to final settlement, with each system automatically receiving the specific file formats and data points it needs to function optimally.

4 best practices for insurance document management

Getting the most out of modern documentation technology requires a strategic approach that balances immediate operational needs with long-term scalability.

The following 4 practices work across different types of insurance organizations, from small agencies to large carriers.

1. Centralization for unified access

Centralization means putting all your claims data and documentation in one integrated system instead of spreading it across multiple digital or physical locations. You create a single location where everyone can find what they need with consistent organization and version control.

The benefit for your team is huge. Instead of searching for documents across different systems, anyone can find specific files in seconds with natural language searches.

Look at Matterport's cloud-based platform, for example. Instead of scattered files and hundreds of photos, all your 3D scans, annotations, notes, and reports are stored and accessible in one place. This means visual property data, written reports, and supporting documents all exist in a single location that authorized team members can access from anywhere.

2. Automation for efficiency gains

Automation reduces your labor costs and speeds up processing by up to 200% within the first year of implementing new systems. That’s a huge incentive to prioritize automation projects.

By automating routine tasks like intake, routing, and standard record-keeping, you can make sure that paperwork is processed consistently and accurately.

When considering upgrading or adding to your tech stack, always look at the potential for automation through native integrations or APIs. It’s important to check that integrations are stable and useful to your team. There’s nothing worse than having to repeat work twice just because two systems can’t talk to each other.

3. Accurate visual context for better decisions

Visual context means embedding detailed visual information directly into your claims files using technologies like 3D digital twins. Instead of relying on static photos that might miss important details, you get immersive documentation that captures spatial relationships and context.

Digital twins capture precise measurements, spatial relationships, and visual details that support accurate assessments whether you're reviewing pre-loss conditions, documenting damage, or planning restoration work.

Visual documentation acts as neutral evidence in contested claims, providing verifiable proof that eliminates arguments and reduces site inspections.

4. Remote collaboration capabilities

The ideal scenario is that a person's location has absolutely no impact on their access to documentation. To achieve this, your documentation should be comprehensive, organized, and cloud-based.

Best practices for remote collaboration include:

Having a “single source of truth” where anyone can go to get the information they need, whether at a desktop or on mobile.

Making information searchable by converting images to text using automation tools, and tagging documents with a central tagging system.

Being intentional about balancing security needs and sharing permissions.

Investing in good equipment so that your team members do not struggle with a camera that has a faulty battery or old hardware.

Adding in colored and label tags, the digital twin makes it easy for customers, contractors, and team members to understand the space.

How customer-first insurance documentation improves the claims process

In 2025, customers have little tolerance for slow claims processing. Recent J.D. Power studies show that customer satisfaction drops dramatically when claims take longer than three weeks, with digital users experiencing satisfaction scores falling from 903 to just 727 when claims extend beyond 31 days. Meanwhile, 82% of customers report they're frequently forced to interact with insurers through non-preferred communication channels.

Effective documentation directly impacts how quickly and accurately you can process claims. When your documentation captures comprehensive visual context, precise measurements, and verifiable conditions, every step of the claims process becomes more efficient.

Use modern documentation for better claims transparency

Uncertainty is a major headache for most claimants. They’re not sure how you’re doing your inspection, what’s included or excluded, or the accuracy of your report. Modern documentation removes the mystery and makes the situation crystal clear.

When customers can access comprehensive property documentation, you can help them understand their coverage, identify potential risks, and make informed decisions about policy adjustments or improvements.

Key transparency benefits:

Time-stamped records provide definitive sources of truth that reduce disputes

Verifiable documentation builds confidence in assessment fairness and accuracy

Educational opportunities help customers understand coverage and identify risks

Meet modern homeowner expectations

Your customers have expectations shaped by their experiences with banking, retail, and streaming services. They expect immediate access to information, self-service capabilities, and transparent processes that let them track progress in real-time.

Modern customers expect from insurance documentation:

24/7 access to their property records, policy details, and claims status through digital platforms

Visual transparency that shows exactly what's covered, damaged, or repaired with immersive 3D documentation

Self-service capabilities to view, download, and share their property documentation without calling customer service

Real-time updates on claims progress with visual evidence of inspection and repair milestones

When you provide comprehensive digital documentation that matches these expectations, you build trust and reduce the administrative burden on both your team and your customers.

Ready to transform your insurance documentation with 3D scans?

Don't let outdated documentation processes hold you back while competitors embrace visual innovation. Your customers already expect seamless, transparent experiences and 3D digital twins deliver exactly that.

Start your free Matterport trial today and discover how leading insurance companies are reducing claim disputes, accelerating settlements, and building stronger customer relationships through immersive documentation.